On a drab, overcast March day in Amsterdam in 2022, Stellantis CEO Carlos Tavares took off his face mask and strode onto a makeshift stage to confidently explain to a crowd of journalists and analysts how the company that had recently unified brands as diverse as Fiat, Peugeot, Maserati, Ram, and Opel was going to rewrite the rules of the car industry. His tie sat slightly askew, and his graying hair needed a trim, the picture of a man far too focused on applying dynamic capitalistic principles to an ossified, margin-destructive business to worry about his appearance.

The Portuguese CEO had it all planned out until 2030. By that point Stellantis would generate software-based revenue of €20 billion from selling customers subscriptions. Distribution costs would be slashed by 40 percent as the traditional dealer model was rebuilt. Electric vehicles would account for 100 percent of Stellantis sales in Europe and 50 percent in the US. Revenue would grow twofold and margins would stay in the magic double-digit space reserved for the best premium and luxury brands.

“It is our blueprint. It is about how Stellantis will engineer the future of mobility,” Tavares said.

If anyone could shake up automotive, it would be Tavares. He’d already spectacularly proven his abilities by returning the perennially loss-making Vauxhall-Opel brand to profitability after leading PSA Peugeot-Citroen’s buyout from General Motors. Now he was ready to apply his private-equity style of management to the newly created behemoth blending PSA Group with Fiat Chrysler Automobiles. Here was a global company with all the fresh energy and scale benefits ready to face the new era.

A little more than three years later, Tavares is gone, and the company posted a €2.3 billion net loss for the first half of 2025 after new boss Antonio Filosa wrote off €3.3 billion, much of it related to those 2022 plans.

A rather forlorn note now sits below the 2022 statement on Stellantis’ website: “Many of our Dare Forward 2030 targets have become increasingly challenging in view of the current trends in market dynamics, government policy and regulation that have emerged since the Plan’s introduction.”

Stellantis is not alone. Other results posted at time of writing included an €837 million half-year loss from Volvo, a second-quarter loss for Ford, and a supposed return to the red for Tesla’s automotive business once emissions credits had been stripped out, according to Philippe Houchois, managing director of autos research at the investment bank Jefferies.

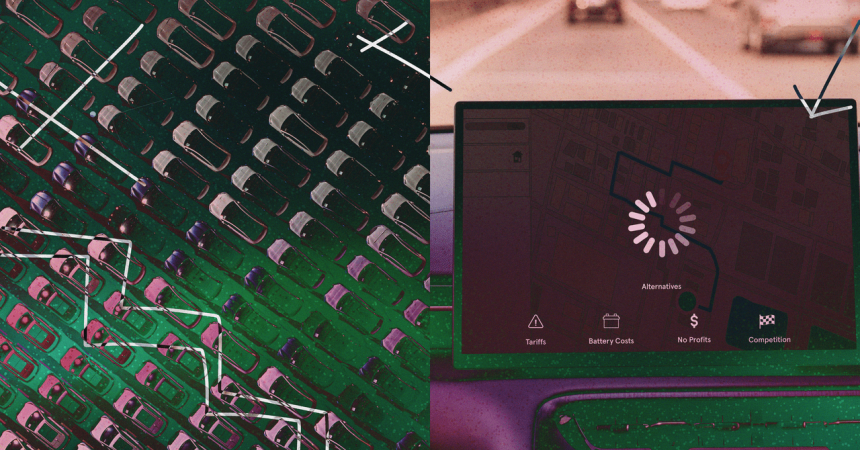

Right now the auto business is very publicly grappling with an existential quandary. Many of the traditional big hitters are trying to navigate the seismic shifts taking place in the car business globally, led by, but not restricted to, the sunsetting of internal combustion and the arrival of cheaper and better EVs from China. But the real concern is that, facing such an onslaught of unfamiliar pressures, automakers—with very few exceptions—don’t have a strategy to get them out of hot water.

Moving Fast Breaks Things

Car companies need long-term plans, because it generally takes four to five years to develop a new model. But the world is moving too fast for the industry to accurately predict what customers will want in four years, what new governments will demand, and what cost targets to hit to be competitive.

“In the good old days, you looked at the market, you looked at the competitors, you looked at the economy, you wrote the plan, and it kind of happened,” Adrian Hallmark, CEO of Aston Martin and formerly Bentley, told a London conference hosted by the Society of Motor Manufacturers and Traders in June. “Now, you write it, throw it away, and just wait.”

Read the full article here