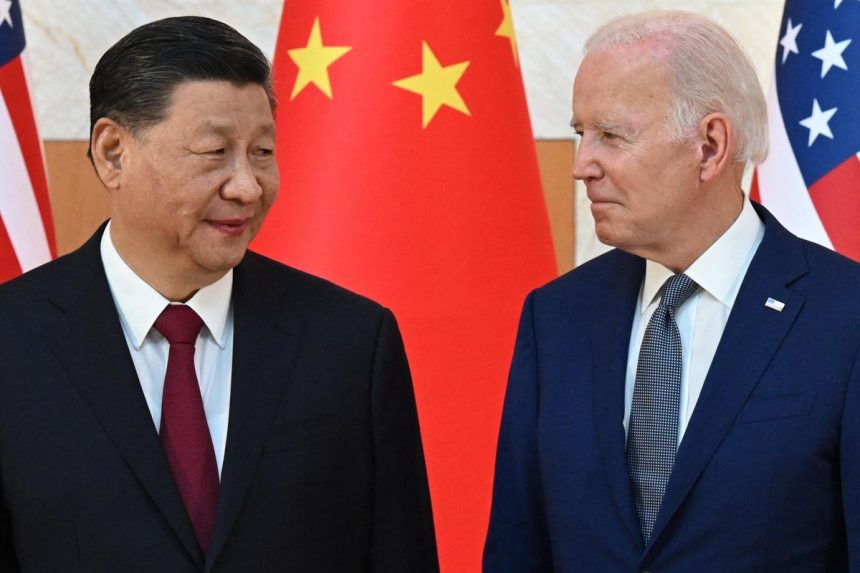

Americans might do well to glance at China to assess the worth of “Bidenomics.” Because the Biden plan is essentially industrial planning and China does that on a grand scale, China’s recent economic failures – most a result of central planning — should stand as a warning to Americans of the potential risks and waste associated with Bidenomics.

Aside from a dubious list of the president’s accomplishments, Bidenomics essentially proposes to have administration thinkers and planners decide what the economy will need tomorrow. It would have them then use subsidies, low-cost loans, tax credits, and the like nudge the private economy in those directions. It is in effect a watered-down version of China’s Marxist, centrally planned approach to economic organization. The president has already touted the billions that have gone to compliant producers, as if somehow those transfers from the taxpayer to corporations have added to the nation’s wealth. Wealth will only emerge if the planners happen on tomorrow’s needs. Otherwise, the effort will produce tremendous waste.

The problem with central planning, whether done in Washington or Beijing, is that no one can see the future. Planners cannot be sure whether consumers will want the products they see as essential. Nor can they anticipate technological advances that might render obsolete today’s seemingly essential technologies. If, as is likely, their plans miss the mark, the economy will have expended huge amounts of capital and labor on wasteful activities, while the diversion of resources will have precluded alternative endeavors that might otherwise have met future needs and spurred growth.

At one time, Chinese planning seemed to have avoided any of these problems. From the late 1970s, when Deng Xiaoping first opened the country’s economy to the world, until very recently, growth rates were spectacular. For a 35-year period from 1980 to 2015, China’s real GDP grew at slightly over 10% a year. When in 2010 China’s burgeoning economy surpassed Japan’s, it was easy to extrapolate its pace of expansion and speculate that China’s economy would soon surpass the that of the United States to become the world’s largest. Everything in China seemed to work. All Beijing’s plans paid off handsomely.

These astonishing advances captured the imaginations of many in the west. Beijing’s leaders and planners seemed prescient. Western enthusiasm raised speculation that China might possess a superior economic model to the seemingly chaotic market-based systems of the United States and to a lesser extent Europe and Japan. The planning and central direction seemed so much more efficient and less wasteful, as well as better thought out than the hit-and-miss of the market. China’s stupendous growth offered a kind of proof statement of the system’s superiority.

Accordingly, it became popular in the west to praise the Chinese model. Canada’s Prime Minister Justin Trudeau expressed envy of how China’s dictatorship could “turn their economy around on a dime.” If this man is not known for deep thinking, other seemingly more sober voices shared versions of Trudeau’s China envy. New York Times

NYT

But the picture was always illusory. More than any planning prescience or systemic efficiencies, China’s success emerged because it was so horribly poor at the start. Poverty gave tremendous leverage to investment flows from the west and Japan that began right after Deng Xiaoping opened China. Underdevelopment also made the job of planning relatively easy. All Beijing’s planners needed to do to see the future was look to the developed world. There they could see the need for reliable roads, power lines, rail links, port facilities, and the like. The pursuit of these projects paid huge economic dividends and spurred growth at still faster rates. Things changed, however, as China’s economy caught up with the developed world. Beijing’s central planners then lost their model of the future. China’s future needs became harder to assess. Mistakes became more common. And because Beijing’s planners have great power to marshal financial and labor resources, those mistakes have created great waste.

China’s present difficulty with residential development illustrates. Years ago, the nation had an inadequate housing stock. The planners could see the need and encouraged development through subsidies, by arranging financing through state-owned banks, and by expediting permitting as well as licensing. Developers responded to the incentives and produced vast apartment complexes. Initially the effort paid off well. But even as the country met its housing needs, planners continued the effort. Riding government support, developers became increasingly leveraged and turned to more dubious projects in less likely places. China until very recently dedicated as much as 30% of its economy to residential housing development. (By comparison the United States in a strong housing year channels about 5% of its economy into residential construction.) China built more housing than its population could absorb and put it in places that Chinese people did not necessarily want to live. These projects failed to pay off, which is why so many Chinese development firms – from the giant Evergrande to Country Garden – have failed.

Residential development is not the only planning failure. The record is replete with roads to nowhere, underused rail links, and misplaced port facilities, as well as chronic electricity shortages. In this China is not alone. Everywhere, except for the underdeveloped that has a model, the future is foggy. America also has many examples of wasted effort due to poor planning, usually by business interests. But there is also a big difference from China’s centrally planned system. America’s market-oriented approach keeps the mistakes on a smaller scale, and because of a greater diversity of effort in a market-oriented system, it is also more likely to happen on future needs sooner than centrally planned arrangements.

In market-based systems, planning is done separately by thousands of firms and individuals. To be sure, business managers are no better at seeing the future than government planners. But each mistake is smaller than in the centrally planned approach that can and does marshal huge amounts of the economy to the comparatively narrow range of activities favored by the planners. Also, unlike government efforts, business planners face tighter budgets, are constantly reviewing their efforts, and because they are also closer to their customers, are less likely to pursue a failing project for as long as will distant central planners. Perhaps most significant is how markets draw strength from their very lack of focus, the lack of discipline and organization that once seemed so attractive in China. The diversity of effort when thousands pursue diverse projects raises the probability that somewhere in the chaotic mélange of activity one of them will uncover one of those elusive future needs, build on it, and spur growth.

Relative debt levels give an idea of the scale of waste caused by centralized planning. Every project, whether promoted by a planning authority or private firms, needs financing and commonly generates debt, whether issued by the central government, local authorities, or private entities. A comparison of aggregate debt levels to income can then indicate the scale of projects that have missed the mark and failed to generate an economic payoff. In China, the extent of that error is huge. Aggregate debt levels have grown at a 23% average annual rate during the ten years ended in 2019, while the economy has grown at an 8% rate. Comparable data for the United States shows a 5.6% annual growth in aggregate debt during this time, faster than the about 4% nominal growth in the economy but a much narrower gap than in China. As of 2022, federal, local, state, and private debt in the United States amounted to some $57 trillion, about 2.2 times the nation’s nominal GDP. In China, comparable debt measures totaled almost three times the size of China’s nominal GDP, suggesting that the accumulated waste from mistaken projects in China is a third again higher than in the United States.

The kind of industrial policies promoted by Bidenomics raise the risk of going down the path that China has taken. Of course, the planners may get lucky. That may be true of China’s planners as well. Not surprisingly, planners in both places have focused on the same future – advanced computer chips, artificial intelligence, electric vehicles, battery technology and its basic inputs – exactly what the headlines claim for the future. These may become the future, but it is just as likely that a new technology will supersede them. That is exactly what happened in the 1980s when the widespread use of Intel’s

INTC

Read the full article here