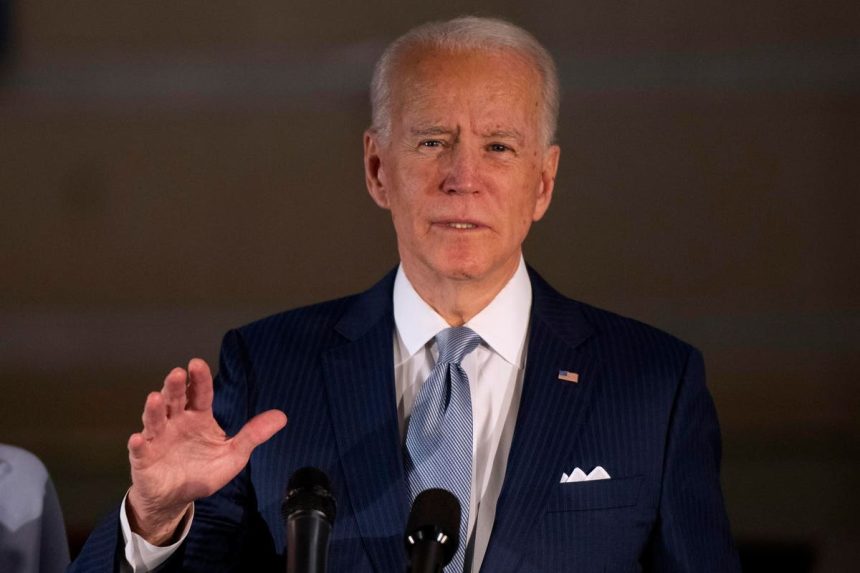

The Biden White House has floated a new student debt relief scheme. Lawyers and judges will decide if this new approach passes constitutional muster, a determination that will almost certainly take until after the 2024 election. But while the legal gears turn — slowly as ever — the political-economic implications are immediate and much the same as last time.

This new scheme is less straightforward than the last. The plan that just lost at the Supreme Court would have forgiven $10,000 in outstanding student debt relief to individuals with incomes of $125,000 a year or less ($250,000 to a married couple) and would have forgiven an additional $10,000 to Pell grant recipients. According to the nonpartisan Congressional Budget Office (CBO), the program would have cost the Treasury some $400 billion in lost revenue flows. The court’s 6-3 decision denied that White House had the authority to do this, as it claimed, under the Higher Education Relief Opportunities Act. The new approach to debt relief is more piecemeal. Already the Education Department has decided to give credit for debt repayments even during a time when no payments were made. The new approach would also extend and enhance the public-service loan forgiveness provision and exclude certain sorts of income from the maximum income calculation. In addition, it would reduce the allowed maximum payment out of disposable income to 5%.

The costs of this new plan would exceed those of the original effort. According to the Education Department, the cost of granting credits even when debtors made no payments comes to some $39 billion. Other changes, according to the CBO, would raise the proportion of debtors getting relief from 50 percent of all student debtors presently to 66 percent. Over a longer time frame, the Penn Wharton Budget Model estimates that ultimately the changes would cover some 91 percent of the debtors and cost some $470 billion over the next decade and still more after that.

Only a fool would try to foretell the legal wrangles about to take place, much less guess how the Supreme Court will ultimately find. But it is a straightforward exercise to identify the political-economic issues this new effort will raise. They are the same as those that surrounded the last effort. Beneficiaries will support it, even as they claim it is insufficiently generous, while resistance will emerge in Congress and elsewhere. The position of the beneficiaries is straightforward in the extreme. On the other side, matters are more nuanced. Questions of equity will dominate, while a need to address the underlying problem will gain some purchase as well.

The first equity issue concerns those who paid for their education out of savings or who borrowed but have already repaid the debt. They would get nothing from this plan. On another level is equity to taxpayers. The denial of repayment revenues to the Treasury would mean that taxpayers would have to fill the financing gap. That burden would fall in part on people who for any number of reasons, doubtless some of them financial, never received a university degree. These people then would have to pay for another to receive a credential with which the recipient can command greater earnings on average than the degreeless taxpayer who foot the bill. It would be doubly unfair to those who paid for their education out of savings or who have paid off their loans. They would not only have paid for their own education but now in this plan will face taxes to pay for another’s.

Beyond this serious equity question is the issue of the underlying causes of these terrible debt problems — the “root causes,” to adopt an expression that has become wildly popular in public policy discussions. Student loans are as large and unsupportable as they are, because college has become insupportably expensive, and college has become as expensive as it has because public monies (often in the form of loans) have become readily available to the educational effort. By paying those debts with taxpayer monies, the new White House plan, like the old one, does nothing to slow or stop this oppressive money spiral that burdens students, family savings, and taxpayers to the benefit of university administrations and faculties, some of the most privileged people in the country. Far from correcting this ugly pattern, the debt-relief plans would extend and enlarge it.

To be sure, this White House, in this plan and the one before it, has made no claim to address “root causes.” Perhaps in the circumstance it asks too much of any single plan to do so. But if it is unreasonable to ask the plan to solve all aspects of this national problem, it is nonetheless, entirely reasonable to ask that it not exacerbate it, as this plan would do and the earlier one would have done.

Read the full article here